Hey everyone,

Let’s talk about the difference between gambling and trading. A gambler hopes. A trader prepares. A gambler plays on a feeling. A trader executes based on a statistical edge. For years, I’ve told traders in our room that the path to consistency is paved with discipline, a solid plan, and an understanding of what the market is most likely to do on any given day.

While no single day is ever a certainty, we can stack the odds so far in our favor that our decision-making becomes ten times clearer. How? By knowing the market’s habits.

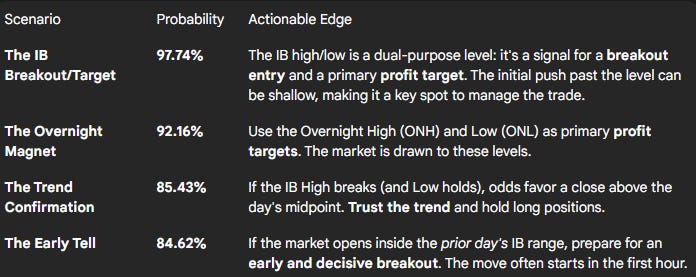

I recently went over a deep-dive statistical report on the E-mini S&P 500 (ES), and a few numbers stood out with such force that they simply cannot be ignored. These aren’t just interesting data points; they are foundational probabilities that can shape your entire approach to the trading day. I’m talking about stats with probabilities over 80%, and today, I’m sharing four of the most powerful ones with you.

1. The Breakout is Almost a Guarantee (97.74%)

First, let’s talk about the Initial Balance (IB). For those who don’t know, this is the price range established in the first hour of the regular session (8:30-9:30 AM CT). This initial range is a benchmark for the day’s sentiment.

Here’s the killer stat: There is a 97.74% probability that the price will break either the high or the low of that initial one-hour range at some point during the trading day.

Think about that. The market is telling us, with near certainty, that the first hour’s range is not the final word. It’s the opening act.

How to use this: Our entire strategy is about finding our edge at the edges, and the IB high and low are the first critical ones drawn each day. These levels serve a powerful dual role. First, they are high-probability profit targets. If you’re in a move heading toward the IB, this is a prime spot to secure gains. Second, they are the launchpad for the day’s larger move. A sustained break and acceptance beyond the IB is the market signaling that the opening act is over and the real trend is beginning. This is the level to watch for a breakout, not a blind fade.

2. The Overnight Magnet (92.16%)

The overnight session isn’t just random noise. It establishes key levels that act as magnets for price during the regular trading day. The two most important are the Overnight High (ONH) and the Overnight Low (ONL).

The data shows that the market will touch either the ONH or the ONL during the regular session 92.16% of the time.

How to use this: The ONH and ONL are not just reference points; they are high-probability targets. When you’re in a trade, these levels become logical areas to take profits. Price is drawn to them. Whether it rejects hard or blows right through, the probability of at least a test is incredibly high. Mark them on your chart every single morning.

3. The Trend Day Confirmation (85.43%)

Okay, so we’ve had a breakout of the Initial Balance. What next? How do we know if the move has legs? This next statistic gives us a powerful clue.

If the IB High is broken but the IB Low remains intact, there is an 85.43% probability that the session will close above the day’s midpoint.

How to use this: This is your confirmation to trust the trend. If you see a clean, decisive break to the upside from the initial range, the odds are now heavily in your favor that the bullish sentiment will stick for the rest of the day. This should give you the confidence to hold your runners and not exit a winning trade too early, as the data suggests a strong close is likely.

4. The Early Tell (84.62%)

Some days, the market gives you a heads-up that a big move is coming early. This final statistic tells you when to be ready for it.

When the market opens inside the previous day’s Initial Balance range, it has an 84.62% probability of breaking out of that range within the first hour of the current session.

How to use this: If you walk in and see ES opened inside the prior day’s 8:30-9:30 AM range, don’t expect a slow morning. This is a setup for an early, decisive, and often aggressive move. The market is signaling that it’s ready to resolve the indecision from the previous day quickly. Be ready at the bell, because the move is likely coming sooner rather than later.

ES High-Probability Trading Cheat Sheet:

By understanding and applying these four data-backed tendencies, you can move from hoping to preparing. You can build a daily plan around what the market does most of the time, not what you wish it would do.